There’s an countless debate over whether or not actual property or shares are the higher asset class. Though I am a fan of each, I simply realized the feel-good wealth impact provides one other feather to actual property’s cap.

In my submit about avoiding the actual property frenzy zone if you wish to get the most effective deal, I highlighted a house that bought 60% over asking, leaping from $2.5 million to $4.05 million. It was an astounding shut that genuinely shocked me. I stroll and drive by that home on a regular basis and assume nothing of it.

After checking in with my actual property agent for some coloration, she defined that early-year stock is extraordinarily tight, so demand is massively outstripping provide. The house was transformed and well-located, so it deserved a powerful end result. Nonetheless, it’s not a home I ever imagined breaking the $3 million barrier this 12 months, not to mention crossing $4 million.

Once I walked by the house once more on my means again to the auto mechanic to select up my automotive, one thing humorous occurred. I now not felt unhealthy about paying extra to repair a coolant leak. I’d already spent about $1,000 changing the water pump a few years in the past. Usually, that will’ve irritated me.

After paying the auto mechanic $415 for the oil service and coolant leak repair (changed a hose for $225), I handled myself to a $10 milkshake, one thing I by no means do when getting a burger. Objectively horrible for my weight-maintenance plan. Subjectively? I felt richer so I figured why not YOLO.

That large home overbid created an actual, speedy feel-good wealth impact. $10 for a milkshake after spending one other $225 on my automotive out of the blue felt like chump change.

Why the Wealth Impact From Actual Property Feels Stronger Than From Shares

Because the starting of 2023, we’ve had an outstanding inventory market run. The S&P 500 is up roughly 80% over the previous three years, making a significant constructive wealth impact that has translated into greater consumption. I’ve even argued that housing affordability is best than it seems to be because of fairness market good points.

Extra inventory returns above historic norms have successfully purchased us extra time, our most beneficial asset.

And but, I’ve come to imagine that the constructive wealth impact from an enormous actual property sale is stronger, deeper, and extra sturdy than even an amazing inventory market rally.

Listed below are the explanation why.

1) Actual Property Positive aspects Really feel Extra Everlasting Than Inventory Market Positive aspects

Actual property strikes like an armored super-tanker. Even in tough waters, it doesn’t sink. It simply retains chugging alongside towards its vacation spot. Shares, in contrast, behave like jet skis: thrilling, quick, and thrilling, however one surprising swell can throw you off and let an excellent white shark take a chew.

Shares don’t have any intrinsic utility. They’re “humorous cash.” A inventory’s worth can get lower in half in a single day after a single earnings name. Or some random exogenous shock that causes demand to fall off a cliff may trigger years of turmoil.

Actual property supplies important utility. All of us want a spot to dwell. The truth is, when the world feels prefer it’s falling aside, housing demand can truly enhance. Within the excessive state of affairs of a zombie apocalypse, you’ll crave a defensible residence base. Your shares aren’t going to do jack shizzle to forestall you from getting bitten.

Rental revenue additionally doesn’t scale back the worth of the underlying property. Dividends, however, are paid instantly out of an organization’s stability sheet. Because of this, the worth of the corporate truly goes down my the decline in money paid out. Due to this fact, rental revenue is superior to dividend revenue.

The Buoyancy Of Actual Property

We’ve seen how fleeting inventory good points may be. In 2021, simple cash and big stimulus despatched equities to nosebleed ranges. Meta went from about $270 to $376, then collapsed 73% to $99 in 2022, wiping out years of good points in a brief time period. Fortunately it got here again.

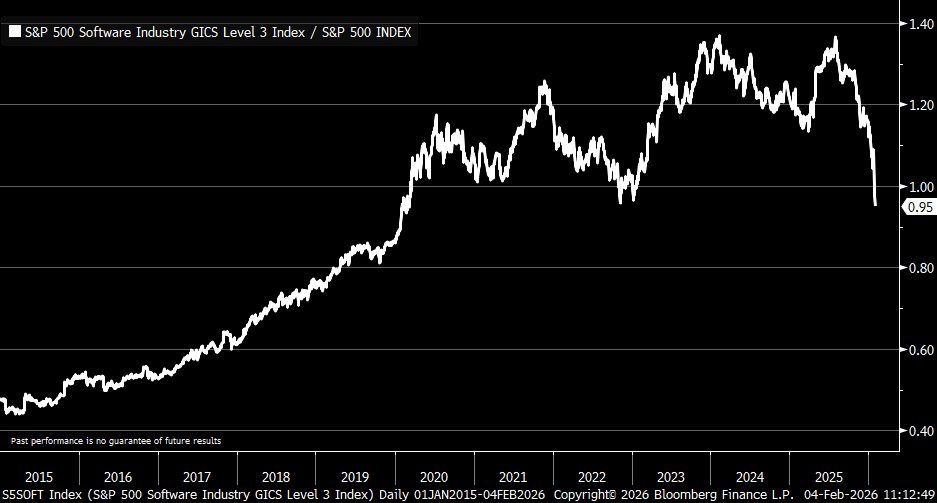

However now software program firms in simply six months have misplaced over 6 years of good points relative to the S&P 500, resulting from fears AI will make SAAS firms and the like out of date.

Bellwether Microsoft, an organization I personal, has misplaced virtually 20% of its worth in only one month. In the meantime, Amazon, one other inventory I personal guided for $200 billion in CAPEX in 2026 resulting from extraordinary demand and the inventory was down as a lot as 11% in after hours.

Housing additionally surged in 2020 and cooled in 2022 when charges spiked. However in contrast to the 20% S&P correction or the 25% – 70% drawdowns in tech shares in 2022, nationwide residence costs largely stalled. Even in harder-hit areas like Texas and Florida, declines had been round 15% after 50%+ good points. You hardly ever see housing corrections that erase years of appreciation so quickly the way in which shares typically do.

In economics, permanence issues. If a achieve feels non permanent, you put it aside. If it feels sturdy, you spend it.

A basic instance just isn’t spending extra in the event you assume there might be tax hikes after a 12 months of tax cuts.

2) Actual Property Wealth Is Extra “Seen,” Which Makes It Extra Spendable

Inventory good points dwell on a display screen. They’re summary numbers that sparkle up and down each buying and selling day. You understand they’ll disappear simply as shortly as they appeared, so that you subconsciously deal with them with warning.

Actual property wealth is bodily and visual. You stroll by it. You sleep in it. Disrespectful neighbors let their canine’s poop on its entrance garden. Comparable gross sales verify it. A $4.05 million closing throughout the road feels actual in a means a brokerage stability by no means does.

This visibility makes the wealth simpler to mentally entry, even in the event you don’t plan to promote your individual residence. It creates confidence, and confidence results in spending.

That’s why a neighbor’s record-breaking sale could make you are feeling richer. The comp simply reset your inner reference level. You may’t assist however examine your property to theirs and bump up your internet price within the course of.

3) Actual Property Gives Stronger Social Proof And Validation

When a home sells at a brand new report excessive, it turns into a public occasion. Brokers discuss it. Neighbors gossip about it. Appraisers recalibrate their assumptions. Lenders, insurers, and future patrons quietly replace what they imagine the neighborhood is price. Value discovery occurs within the open, bolstered by a number of unbiased third events directly.

This sort of validation feels wonderful. Actual property appreciation isn’t simply mirrored on a personal assertion; it’s embedded into comparable gross sales, itemizing costs, and neighborhood narratives. One sale can re-anchor a complete block’s notion of worth. The achieve feels actual as a result of it reshapes what others are prepared to pay in the identical bodily area you occupy day-after-day.

Inventory good points, in contrast, are lonely and summary. No person throws a block celebration as a result of the S&P 500 hits a brand new excessive. There’s no shared acknowledgment, no communal recalibration of price. If you happen to point out a giant fairness win, folks are likely to assume you both obtained fortunate or took reckless danger. And since no one likes a braggart, most inventory good points keep quietly hidden behind a login display screen.

With actual property, your wealth turns into socially validated with out self-promotion. In any case, the purpose of investing in shares is in the end to show paper good points into one thing tangible and significant. For most individuals, meaning shopping for a house, other than funding retirement. In a world the place most monetary wins are invisible, this quiet recognition dramatically amplifies the feel-good wealth impact.

4) Actual Property Positive aspects Take Extra Effort, Inventory Positive aspects Far Much less So

As a result of actual property isn’t a 100% passive funding – usually a unfavourable variable in my passive revenue rankings – its good points satirically really feel extra earned. If a transform was concerned, much more so given its one of the painful processes an individual can undergo. Actual property rewards endurance, self-discipline, ongoing upkeep, and lengthy holding intervals. There’s actual work behind the end result, each bodily and psychological.

Climbing the property ladder takes a long time. Alongside the way in which, you often save aggressively for a big down fee, then summon the braveness to tackle an enormous quantity of debt to purchase a particularly costly, illiquid asset. Parts of your own home will break and should be mounted. That’s dedication, plain and easy.

Inventory investing, by comparability, is deliberately frictionless. You click on, allocate, rebalance, and wait. That effectivity is financially optimum, however psychologically it dulls the payoff. Returns really feel nearer to luck or market tides than private sacrifice, leading to a thinner, much less sturdy feel-good impact, even when the numbers look nice on paper.

Get Impartial Actual Property As Early As You Fairly Can

If the feel-good wealth impact from actual property is stronger than inventory market good points, the logical takeaway isn’t to invest more durable. It’s to get impartial actual property as early as attainable.

Getting impartial means proudly owning your major residence so housing inflation now not works in opposition to you. As an alternative of rising costs making life extra anxious, they start working quietly in your favor by means of:

- Inflation safety in your largest recurring expense

- Pressured financial savings by means of principal paydown

- Lengthy-term appreciation supported by rising substitute prices

You don’t want a portfolio of rental properties to learn. Proudly owning only one residence already adjustments the equation. By locking in your housing prices, you hedge the one largest expense in your funds. For a lot of households, that alone justifies possession—even earlier than appreciation or rental revenue enter the image.

The psychological payoff is speedy, particularly as a father or mother. When shelter is secured, the whole lot else feels extra manageable.

Shares are important for liquidity and long-term development. However relying solely on shares whereas remaining absolutely uncovered to housing inflation as a renter is an underappreciated danger.

Actual Property Quietly Wins

The largest false impression is that shares alone ship monetary safety. They don’t, not less than to not the diploma folks count on. Shares can develop your internet price on paper, however their volatility makes that wealth really feel fragile and reversible.

Actual property works otherwise. Proudly owning your property converts your largest recurring expense into an asset and turns housing inflation from a risk right into a tailwind. Over time, it replaces monetary nervousness with a way of management that portfolios alone wrestle to supply.

With actual property, it’s not nearly returns, it’s about permanence. It doesn’t matter what the market does tomorrow, your loved ones nonetheless has a roof over its head. That stability creates a confidence that quarterly statements hardly ever match.

Each shares and actual property generate wealth results. However actual property wealth feels extra sturdy, extra seen, and extra actual. Because of this, individuals are way more prepared to loosen the purse strings when their housing state of affairs feels safe.

That’s how a record-breaking residence sale down the block out of the blue makes an expensive automotive restore really feel acceptable, an indulgent lunch really feel earned, or perhaps a utterly pointless $10 milkshake appear to be an affordable life selection – maybe adopted by a $250-a-month fitness center membership to burn it off.

Readers, which creates a stronger feel-good wealth impact: a giant actual property sale or inventory market good points? If you happen to disagree with my thesis, I might like to know why.

Strategies For A Wealthier Life

Decide up a duplicate of Millionaire Milestones, my instantaneous USA Right this moment bestseller. The e book helps you construct extra wealth so you’ll be able to break away sooner.

Subscribe to the Monetary Samurai podcast on Apple or Spotify. Your shares and constructive opinions are appreciated.

For extra nuanced private finance content material, be a part of 60,000+ others and join the free Monetary Samurai e-newsletter. This manner, you by no means miss a factor.