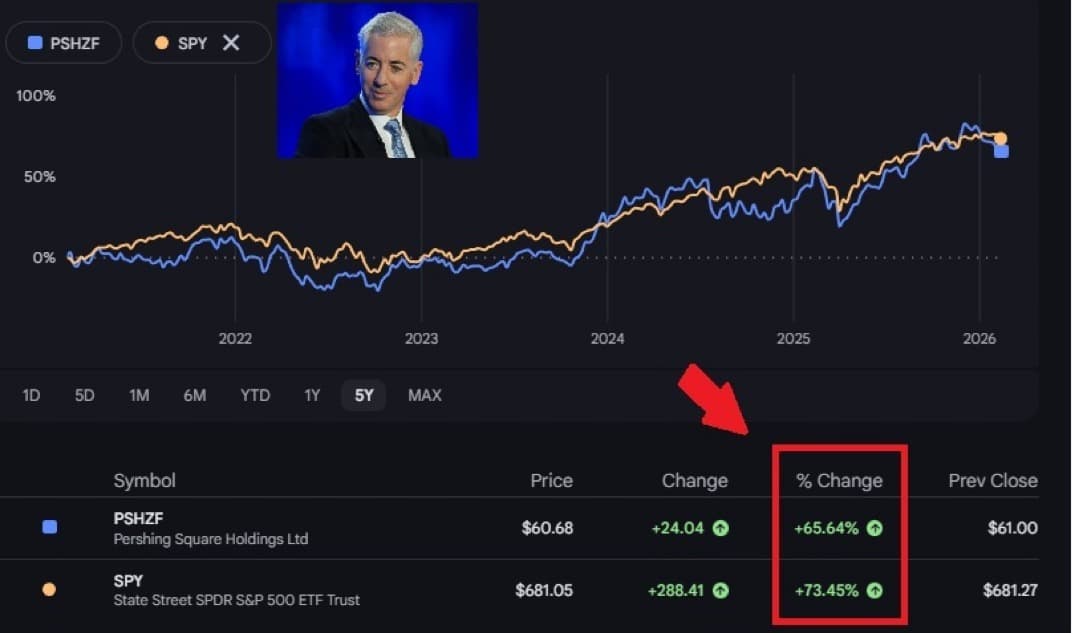

In an try to raised perceive the potential {discount} or premium to NAV for the Fundrise Innovation Fund (VCX), I wished to look at Pershing Sq. Holdings, ticker PSHZF, listed on the London Inventory Alternate.

Pershing Sq. manages over $18 billion and is run by American, Invoice Ackman. In the meantime, the fund at the moment trades at a few 25% {discount} to its NAV. When it first listed in 2014, it traded at as small as a 9% {discount}. The NAV {discount} widened to about 40% in 2022, after which traded at a 30%–35% {discount} in 2023 and 2024.

As an investor, you possibly can take this -9% to 40% historic discount-to-NAV vary as a datapoint for when to speculate. Clearly, the larger the {discount} to NAV, the higher worth you might be getting. Not solely may the NAV rise in worth if Ackman invests in winners, however the {discount} to NAV may slender as nicely.

If the Innovation Fund lists on the NYSE, may it commerce at an identical {discount} to NAV as Pershing Sq.? It’s attainable, however I extremely doubt it for the explanations I spotlight on this submit.

Why Does The Pershing Sq. Fund Commerce At Such A Giant Low cost?

Listed here are 4 most important causes for such a persistent {discount} to NAV.

1) Core Holdings Are Public Equities

Pershing takes concentrated positions in 8–12 holdings and actively engages with administration to impact change. Previous holdings embody Chipotle, Restaurant Manufacturers Worldwide, Hilton Worldwide, Alphabet, Canadian Pacific Kansas Metropolis, and Amazon.

The problem with proudly owning public equities is that you and I can assemble the identical portfolio ourselves. In different phrases, there is no such thing as a barrier to entry to proudly owning public equities. Fund traders should depend on the acumen of Ackman and his analysts on when to purchase and promote.

Regardless of many of the positions being public equities, Ackman did use credit score safety to hedge draw back threat in the course of the early 2020 COVID volatility. So if you’re investing in a hedge fund and wish draw back safety, Pershing can present that functionality. But it surely often would not appear to, going 90% – 100% lengthy.

2) Closed Construction + European Itemizing

PSH is a closed-end fund listed in London, not a ETF listed on a U.S. inventory trade.

That creates:

- No every day redemption mechanism to arbitrage worth again to NAV

- A restricted pure U.S. investor base that does not put money into LSE shares or funds

- Much less index inclusion versus U.S. funds

- Some institutional mandates that can’t personal foreign-listed Closed-end Funds (CEFs)

If this have been a U.S. ETF holding the very same portfolio, the {discount} probably wouldn’t practically be as massive. Perhaps 0-5% as a substitute. Closed-end funds can commerce at reductions for many years if there is no such thing as a catalyst to shut the hole.

Not like an ETF, there is no such thing as a easy mechanism forcing convergence, as I wrote in my submit on how totally different fund sorts commerce.

3) Price Construction (1.5% + 16% Efficiency Price)

PSH expenses:

- 1.5% administration charge

- 16% efficiency charge above a high-water mark

That’s cheaper than conventional 2/20 hedge funds, however it’s costly relative to passive fairness publicity. In the meantime, traders mentally {discount} future returns as a result of charges compound.

If you {discount} anticipated future NAV development by charges, some traders demand a structural {discount}.

4) Focus Threat And Volatility

With often solely 8–12 shares within the portfolio, there’s vital focus threat in PSH that warrants a reduction. Throughout good instances, returns will be nice. However throughout unhealthy instances, like in 2022, returns will be horrible, therefore the 40% {discount} to NAV.

If you’re investing in a hedge fund, your aim is often to cut back volatility and defend draw back threat via hedging (shorting some names). But when the fund doesn’t hedge meaningfully or persistently, and as a substitute creates extra volatility for holders who should not fitted to it, a reduction to NAV is demanded.

With supervisor threat, key-man threat, and technique cyclicality, a reduction to NAV is barely pure.

Fundrise Innovation Fund Comparability To Pershing Sq. Holdings

Buying and selling at a 25% {discount} to NAV after a NYSE itemizing could be a horrible situation for Fundrise Innovation Fund (VCX) holders. Nonetheless, I don’t assume it’s going to occur given the next variations in comparison with Pershing Sq. Holdings:

1) VCX Owns Non-public, Onerous To Make investments In Belongings

VCX owns extremely coveted personal firm shares in names akin to OpenAI, Anthropic, Databricks, Anduril, SpaceX, Canva, and extra. Not like public equities, only a few folks can make investments straight in these firms throughout their subsequent personal fundraise. Consequently, it’s logical that traders would pay a premium to personal these names, not a reduction.

2) VCX Will Commerce On A A lot Bigger U.S. Alternate

VCX will attempt to record on the NYSE, not the London Inventory Alternate. The NYSE is 8–9 instances bigger than the LSE by way of complete market capitalization. Buying and selling quantity on the NYSE is often $50–$100+ billion per day versus solely $5–$10+ billion per day on the LSE.

Consequently, the pure demand pool is bigger. VCX could be obtainable to each U.S. retail brokerage account and will doubtlessly entice institutional flows.

3) VCX Costs A A lot Decrease Price

VCX plans to cost a 2.5% annual administration charge and 0% carried curiosity (a share of earnings). PSH expenses solely a 1.5% administration charge, however 16% of earnings after a high-water mark, which is a part of the rationale Ackman is so rich. I’d a lot moderately pay 2.5%–3% of AUM than 1.5% and 16% of earnings for firms which have the potential to development tremendously.

Hypothetically, in case your $100,000 place doubles to $200,000 in a single 12 months, you’d pay an roughly $3,750 charge to VCX and maintain $96,250 of the earnings. In distinction, you’d pay a $2,250 charge to PSH plus 16% of the $100,000 revenue, or $16,000, for a mixed complete charge of $18,250. Clearly, paying a $3,750 charge is preferable to paying an $18,250 charge.

4) VCX Manages A Smaller, Extra Nimble Fund With Extra Holdings

VCX is a ~$550 million fund versus PSH at $18+ billion. Consequently, it’s typically more durable to outperform with such a lot of belongings below administration.

For instance, investing $55 million (10% of VCX) in a non-public development firm that performs nicely could make a much bigger distinction to VCX than to PSH (0.3%). Taking an identical 10% place, or $1.8 billion in PSH, would have a tendency to maneuver the inventory considerably and even be inconceivable if Ackman wished to put money into a smaller firm attributable to restricted float.

VCX owns at the least double the variety of firms as PSH. Nonetheless, about 75% of VCX is concentrated in OpenAI, Anthropic, Databricks, Anduril, dbt Labs, Vanta, Canva, and Ramp. So I’d say the focus threat is just like PSH’s 8–12 firms.

Conclusion In regards to the PSH Case Research

I extremely doubt the Innovation Fund will commerce at an identical {discount} to Pershing Sq. Holdings. They’re basically totally different autos, with totally different asset bases, charge constructions, investor audiences, and structural dynamics. Though each are closed-end funds and lack the redemption mechanism of ETFs, the similarities largely finish there.

Pershing’s {discount} is primarily a operate of its public fairness publicity, closed-end construction with out a redemption mechanism, European itemizing frictions, efficiency charges, and focus threat. VCX, in contrast, supplies entry to scarce personal belongings, intends to record in the US, and doesn’t have a efficiency charge drag.

Whereas no listed automobile is immune from buying and selling at a reduction, making use of Pershing Sq.’s historic {discount} vary on to the Innovation Fund is probably going the flawed framework.

Future Tech100 (DXYZ) and Robinhood Enterprise Fund (RVI)

A extra applicable comparability could also be DXYZ, which is at the moment buying and selling at roughly a ~140% premium to its roughly $11.50 NAV, and the soon-to-be-listed RVI, the Robinhood Enterprise Fund.

Each maintain related hard-to-access personal development firms which can be in excessive demand. It is going to be telling to see whether or not RVI additionally trades at a premium to NAV following its $1 billion providing. If it does, the probabilities of VCX buying and selling at a premium goes up. As of two/20/2026, no new investments will be made in VCX pre itemizing.

As we get nearer to RVI’s itemizing, I plan to publish a follow-up evaluation analyzing how its efficiency might inform expectations for the Innovation Fund.

I’m doing this work primarily as a result of I’ve roughly $770,000 invested in the Innovation Fund, which may realistically swing down by $150,000 or rise by as a lot as $385,000 merely based mostly on itemizing dynamics.

As a result of my spouse and I wouldn’t have day jobs, we rely closely on our investments to fund our way of life. As a DIY investor, I have to conduct deeper due diligence to enhance the percentages of creating sound, long-term funding selections.

Anybody right here investing in Pershing Sq. Holdings? In that case, what are your ideas on method the fund given its {discount} to NAV? Wouldn’t it’s higher to only put money into an S&P 500 ETF with minimal charges, provided that efficiency has been related over the previous 5–7 years?

Fundrise is a long-time sponsor of Monetary Samurai, as our funding philosophies are aligned. Please do your due diligence earlier than making any funding and solely make investments an quantity you possibly can afford to lose. There aren’t any ensures when investing in threat belongings, and you may lose cash.