My major aim for this web site is that will help you obtain monetary freedom sooner relatively than later. And when you’re nonetheless in your path to monetary freedom, sending your youngsters to non-public grade college usually works in opposition to that goal.

I’ve skilled freedom from bosses, work journey, rush hour commutes, and shopper pressures since 2012. And I can unequivocally inform you the sacrifices you make to succeed in FIRE are properly price it. Your well being improves. Your happiness will increase. And also you lastly have the area to search out one thing significant to do along with your one and solely life.

On this submit, I need to spotlight the newest non-public grade college tuition figures out of New York Metropolis and remind you to run the numbers earlier than taking the plunge. The chance value shouldn’t be fairly.

The very last thing you need is to sacrifice 10+ years of retirement simply to ship your youngster to non-public grade college, just for them to graduate, attend the identical schools, and pursue the identical careers as everybody else who didn’t pay an arm and a leg for schooling.

The Personal Grade Faculty Debate Started Earlier than Our Kids Had been Born

Paying for personal grade college tuition is one thing I’ve debated since 2016, a 12 months earlier than my son was born. We visited a few non-public grade faculties in Honolulu, and I wrote about whether or not paying for personal college was price it.

Like most mother and father, we initially paid for personal preschool as a result of cities don’t present free childcare to households not in poverty. Then COVID hit, and my spouse and I homeschooled our son for 18 months each as a result of we may and to guard our child daughter.

It was refreshing to get a break from tuition. However as our investments grew and our need for bilingualism elevated, we determined to ship our youngsters to a Mandarin immersion college.

At this time, the fee is about $44,000 per youngster per 12 months, or $88,000 in after-tax earnings for our two youngsters. At a 30% efficient tax price, that requires roughly $125,000 in gross earnings simply to cowl tuition.

That’s some huge cash, taking on about 34% of our passive earnings. In consequence, I’m nonetheless continuously reassessing every year whether or not it’s price it.

The Worth Of Mastering A Second Language Issues To Us

That stated, our youngsters are comfortable, the college is superb, and we extremely worth studying a second language. I’d personally pay $500,000 or extra to be fluent in one other language. When you’ll be able to really communicate a second language, your world expands.

I beloved residing in Taiwan for 4 years as a child and finding out overseas in China for six months in 1997 throughout school. Studying to assume and dream in one other language is a present. It’s virtually like being FIRE, the place you get to stay two lives earlier than and after retirement, however mentally.

Simply think about how rather more you’d’ve loved the 2026 Tremendous Bowl halftime present that includes Unhealthy Bunny when you understood Spanish.

Debí tirar más fotos de cuando te tuve. Debí darte más beso’ y abrazo’ las vece’ que pude. As a FIRE practitioner who’s delicate to how fleeting life is – and the way shortly our youngsters develop up – I really feel these lyrics from the tune, DtMF.

Too dangerous, after 4 years of finding out Spanish in highschool, and two years residing within the Spanish Home at William & Mary, my Spanish is horrible. I want I began finding out sooner.

Paying Personal Grade Faculty Tuition At The Expense Of Your Monetary Well being

Let’s be trustworthy. Studying a second language is not vital, particularly when you don’t plan to stay overseas. English dominates, and know-how now interprets languages immediately and at no cost.

Very like school, mastering a second language has develop into a rising luxurious. There are additionally public faculties that educate second languages at no cost, although only a few begin as early as preschool.

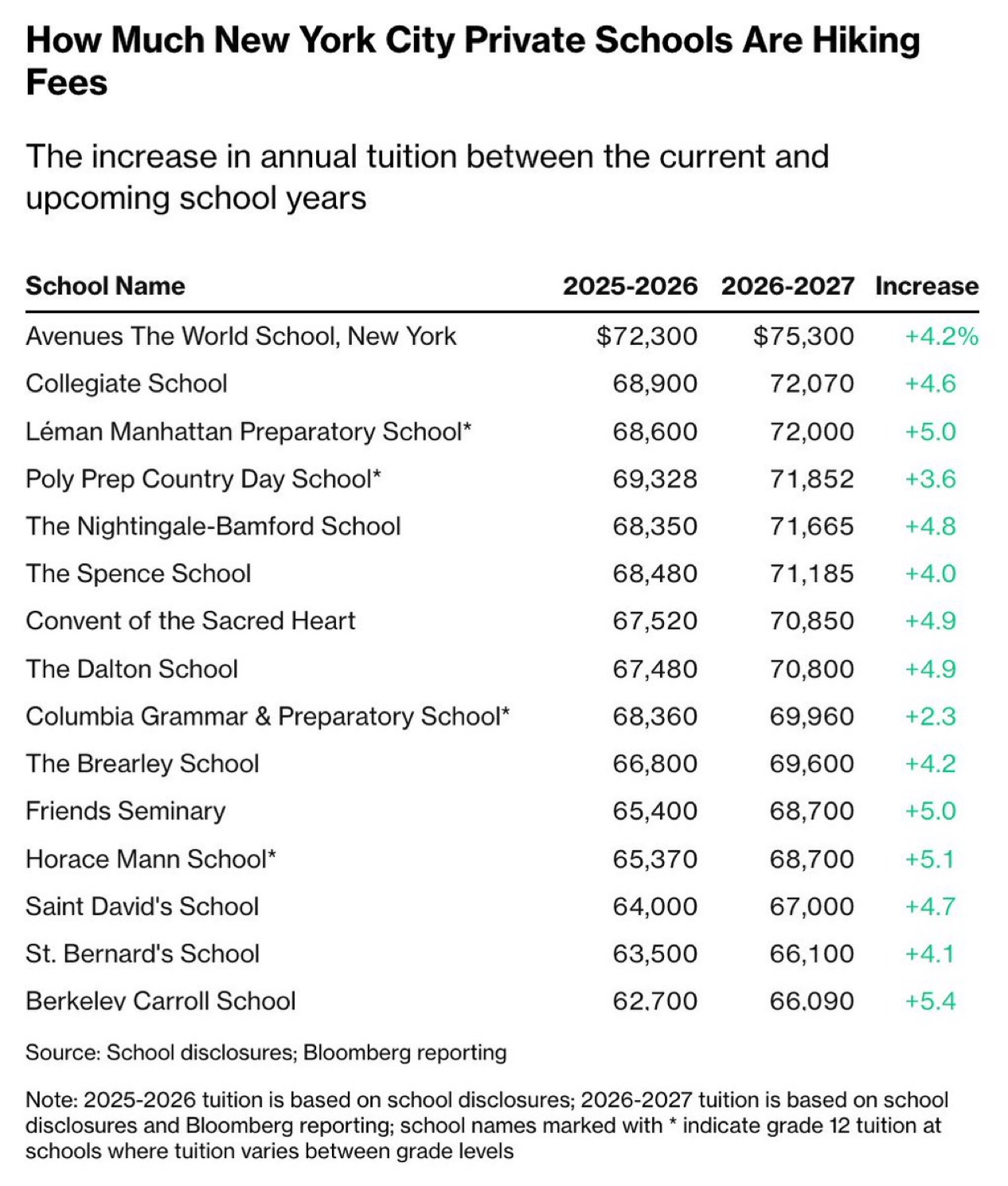

So after I noticed the newest New York Metropolis non-public college tuition for 2026–2027, I used to be impressed. Although some debate it, New York Metropolis is at the least 20% dearer than San Francisco. Seeing faculties cost $70,800 to $75,300 per 12 months is staggering.

At a 30% efficient tax price, a household must earn at the least $100,000 in gross earnings simply to pay annual tuition for one youngster.

Three Varieties Of Households Who Ship Their Kids To Personal Faculty

After 4 years of personal education and talking with a whole lot of oldsters, there are three essential teams who ship their youngsters to non-public college:

The ultra-wealthy, incomes properly over $1 million a 12 months and/or with web worths properly north of $20 million. To them, $70,000+ per youngster barely registers. They’re comfortable to spend freely on schooling. I estimate they make up about 20% of all non-public college households.

Decrease-income households, sometimes incomes below $200,000, who obtain substantial monetary assist. These households usually make up about 20% of the coed physique. The $200,000 cutoff aligns with requirements utilized by elite universities like Yale and Harvard. I estimate in addition they make up 20% of all non-public college households.

The mass prosperous, or HENRYs, incomes roughly $300,000–$600,000. They earn an excessive amount of for significant assist however not sufficient to really feel snug paying full tuition. That is the kind of household who has an opportunity to FIRE, however finally ends up working 60 hours every week and grumbling about life, partially attributable to non-public grade college. I estimate these make up the majority of personal college households, about 60%.

When you’re ultra-wealthy or closely backed, non-public college is manageable. It’s the mass prosperous class that will get squeezed, paying 80%–100% of tuition whereas deciding whether or not non-public college is definitely worth the tradeoff.

Run The Numbers On What Personal Faculty Tuition Actually Prices

Let’s assume when your youngster turns 5 and enters kindergarten, you begin investing $70,000 a 12 months for 13 years as a substitute of paying non-public college tuition. Your contributions enhance by 5% yearly, and also you earn an 8% annual return. By the tip of that interval, you’d accumulate roughly $2.1 million nominally. Adjusted for 3% annual inflation, that equates to about $1.43 million in at the moment’s {dollars}.

Scale back the beginning contribution to $50,000 below the identical assumptions – 5% annual contribution development, 8% annual returns, invested for 13 years starting at age 5 – and the ending worth comes out to roughly $1.5 million nominally, or about $1.02 million in at the moment’s {dollars} after adjusting for 3% inflation.

That’s the actual value of personal college, not simply the schooling value. And I haven’t even included 1-3 years of preschool tuition, which might simply run $25,000 to $60,000 a 12 months.

When you’re center class, sending your children to public college and investing the distinction is usually the smarter transfer. Giving every youngster $1 – $1.4 million in at the moment’s {dollars} after they flip 18 is tough to argue in opposition to.

Ask your child in the event that they’d relatively have one million {dollars} at 18 and attend public college, or attend non-public college and obtain nothing. The reply is clear.

Years Taken Away From Retirement

Now let’s apply this to an actual family.

Assume a $500,000 family earnings in New York Metropolis. Two youngsters require roughly $200,000 in gross earnings yearly for personal grade college tuition alone. After taxes and residing bills, the family saves $50,000 a 12 months, or 10 % of gross earnings. Respectable, however not precisely aggressive in case your aim is monetary independence.

Let’s assume that $50,000 is invested yearly at an 8 % return.

To build up $1.02 million after tax (roughly the lower-end inflation-adjusted alternative value for one youngster), it could take about 12 to 13 years of constant saving.

To build up $1.43 million after tax (the higher-end inflation-adjusted alternative value), it could take about 15 to 16 years.

That’s per youngster.

When you’ve got two youngsters, you’re looking at roughly 15 to twenty further working years to exchange the misplaced compounding, assuming markets cooperate and also you keep disciplined.

Do you actually need to work an additional decade or two so your youngster can attend non-public college from age 5 to eighteen?

If you have already got the wealth or substantial free monetary assist, the choice is less complicated. However if you’re center class and grinding towards freedom, you should be trustworthy concerning the tradeoff.

You aren’t simply shopping for schooling. You might be doubtlessly promoting years of your life.

$500,000 Family Revenue And Price range

To provide you a crystal clear view of how shortly a $500,000 family earnings disappears, I’ve put collectively an up to date price range chart with cheap bills for a household of 4. As a substitute of assuming $70,000 plus per youngster in non-public grade college tuition, I used a extra conservative $60,000.

Their house is a modest three bed room, two and a half lavatory home with about 1,900 sq. toes in an excellent neighborhood. The couple saves a mixed $40,000 a 12 months of their 401(okay) plans and one other $10,000 a 12 months throughout two 529 plans.

After protecting all bills, they’re left with about $20 a 12 months. Let’s hope there are no emergency bills that come up.

Now think about what number of extra years the mother and father need to work in the event that they solely make $300,000 a 12 months? A lifetime!

And keep in mind, if you spend this a lot on non-public schooling, expectations rise. Dad and mom naturally hope for elite schools, distinctive careers, and monetary outperformance. When outcomes find yourself much like these of public-school friends, disappointment can creep in.

The Wealthy Are Actually Wealthy

Now you see how rich households comfortably afford $70,000 per 12 months for 13 years. To them, spending $1–$2 million per youngster doesn’t materially dent their web price.

A $20 million portfolio rising 10% produces $2 million in positive aspects. That single 12 months of returns can cowl a long time of tuition.

For these households, non-public college is the default selection. Even when there’s just one fewer scholar on common per class, it is definitely worth the tuition.

The highest 20 % of households are successfully anticipated to subsidize the underside 20 % by means of donations on high of full tuition. In the meantime, the remaining 60 % of households incomes higher center class incomes are those getting stretched the thinnest.

Revenue And Web Price Pointers

If you’d like the choice to retire earlier than 60, earn at the least 7X web tuition per youngster. Paying $70,000 means incomes roughly $490,000 with one youngster, or $980,000 with two. With a $20,000 low cost, $350,000 for one or $700,000 for 2, could suffice.

After 2020, I raised the rule from 5X to 7X as schooling ROI declines attributable to know-how. Nevertheless, you’ll be able to nonetheless use the 5X guideline if you want.

For web price, goal for 25X web tuition, excluding your major residence. In different phrases, Paying $71,000 requires at the least $1.78 million in investable property per youngster.

Whereas 25X is a naked minimal for FIRE, tuition is non permanent, and property normally compound sooner than tuition inflation. Additional, I assume you’re nonetheless working and including to your retirement portfolio.

If these pointers sound harsh, don’t fear. They’re pointers, not guidelines of regulation. When you select to not comply with them, simply be trustworthy concerning the tradeoff and mannequin extra years of labor and fewer years of retirement. That method works properly when you really love what you do.

Why I’m Nonetheless Uncomfortable Paying So A lot

As FIRE mother and father in San Francisco, we’re thought of middle-to-low earnings however have excessive web worths after a long time of compounding. We pay full tuition, donate what we are able to, and really feel the squeeze. Practically all of our passive earnings now goes towards residing bills.

That’s regular post-FIRE. Youngsters are glorious decumulators of wealth. Nonetheless, spending this a lot after 20+ years of aggressive saving is uncomfortable. I am making progress, however most likely nonetheless want a number of extra years to be absolutely snug.

Long run, I’d relatively relocate to Honolulu earlier than highschool, the place tuition in San Francisco is at present round $60,000 a 12 months. Personal tuition there’s nearer to $36,000 per 12 months by means of highschool, saving between $8,000 – $24,000 a 12 months after tax per child.

That tradeoff alone may let me repair my 11-year-old automotive stress free and purchase countless quantities of one of the best Hawaiian poké and mangos. I gotta say, that sounds fairly superb to me!

Are you a mass prosperous guardian paying non-public grade college tuition? If that’s the case, how do you justify the fee, and are you ready for you or your partner to work many extra years than vital? And have you ever ever requested your youngster whether or not they would relatively attend public college and obtain over one million {dollars} at 18, or attend non-public college and obtain nothing?

Recommendations For A Higher Life

When you’ve got debt and youngsters, defend your loved ones with an reasonably priced life insurance coverage coverage by means of Policygenius. My spouse and I each secured matching 20 12 months time period life insurance coverage insurance policies in the course of the pandemic to guard our two younger youngsters, and as soon as we did, an amazing quantity of economic fear disappeared.

If you wish to hedge in opposition to AI disrupting your youngsters’s livelihoods as soon as they graduate, take a look at Fundrise Enterprise. It invests in among the high non-public AI corporations, together with OpenAI, Anthropic, and Databricks. Investing in AI has made me really feel significantly better about all of the disruption forward. The minimal funding is simply $10.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Monetary Samurai e-newsletter. You can even get my posts in your e-mail inbox as quickly as they arrive out by signing up right here. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. Each Policygenius and Fundrise are affiliate companions of FS.